Table of Contents

ToggleXiaomi Mijia Smart Camera Global Expansion: What 2025 Tells Us

As a top player in China’s home surveillance market, Xiaomi Mijia cameras have become increasingly popular abroad, riding the wave of global smart home adoption. But how are they really performing outside China?

Let’s break down their overseas market strategy, sales performance by region, and product adaptation — and what this means for B2B security brands worldwide.

Regional Sales Overview: Where Xiaomi Is Winning

🌏 Asia-Pacific — A Strategic Stronghold

Thanks to its strong brand ecosystem and e-commerce channels, Xiaomi has gained impressive traction in Southeast Asia (especially Indonesia, Thailand, and Vietnam).

Suggested Image: Bar chart showing 2025 Q1 smart camera sales share in Southeast Asia (Xiaomi vs competitors)

External Link Suggestion: Link to Canalys Smart Home Tracker – Asia 2025 (if available)

According to Q1 2025 data, Xiaomi leads the indoor camera segment in China’s online market with a 25% market share, reflecting strong spillover demand across nearby markets.

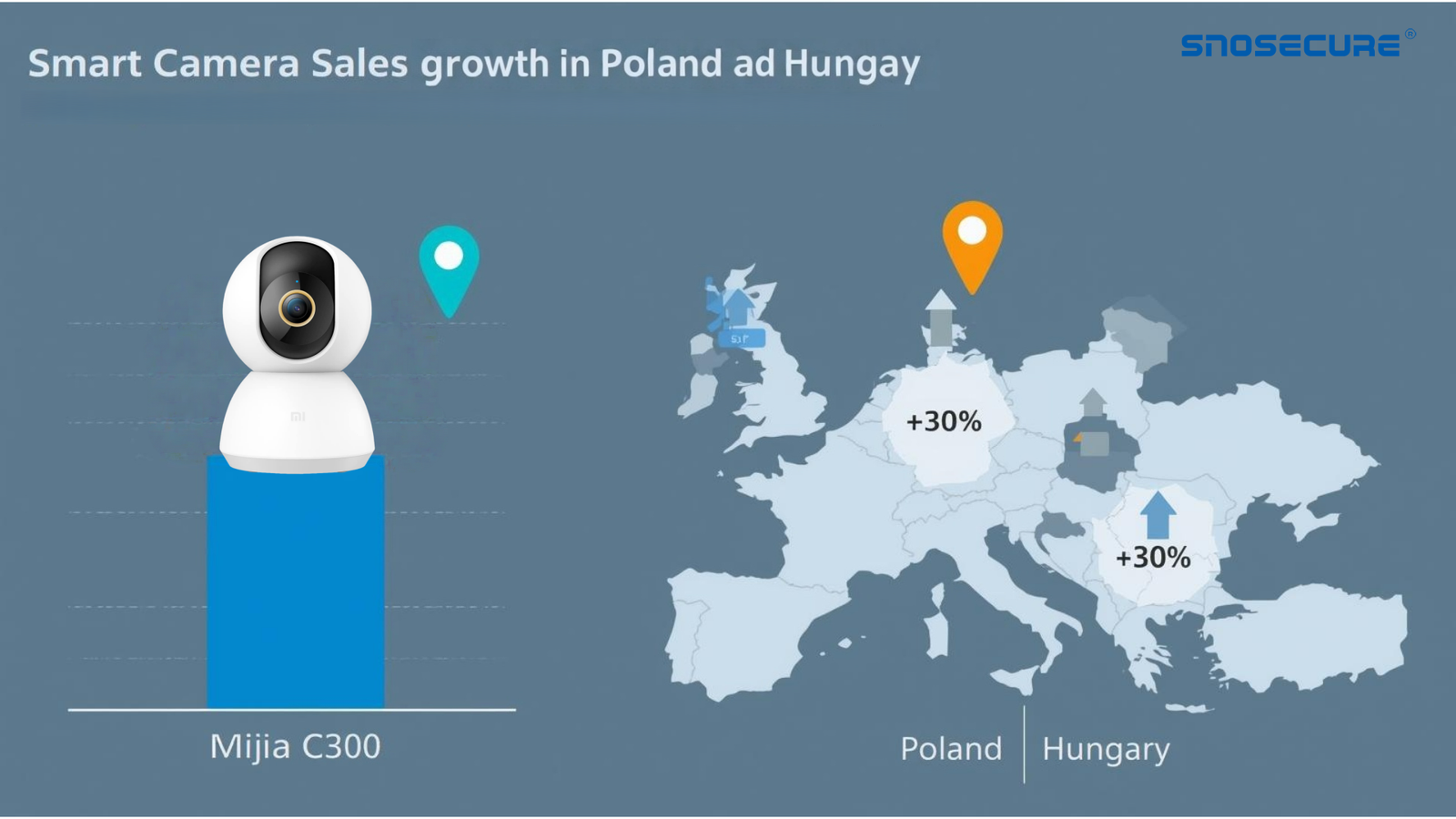

Eastern Europe — The Hidden Gem

Markets like Poland and Hungary have shown 30%+ year-on-year growth, driven by:

Xiaomi’s affordable pan-tilt camera models (like the C300 International Edition)

Localized product optimization for Wi-Fi, storage, and voice assistant integration

Latin America — Outdoor Cameras for Harsh Climates

In Brazil and Mexico, the rising demand for home security is driving Xiaomi’s outdoor models such as the Mi Outdoor Camera 4C, featuring:

IP66 waterproof housing

H.265 compression

Local data compliance

Internal Link Suggestion: Link to your own SNOSECURE outdoor solar camera page to compare product lines.

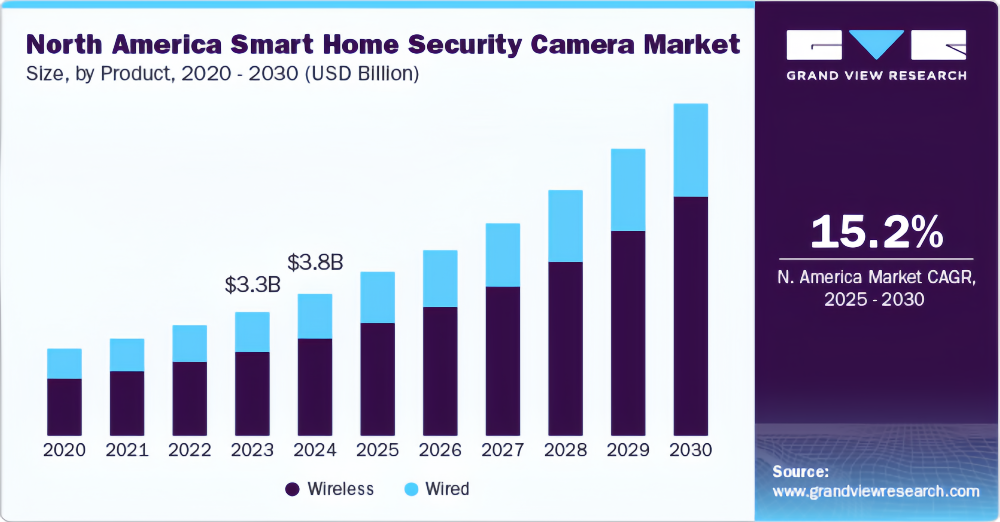

North America — Still a Work in Progress

While not yet in the top 5 (dominated by Ring, Arlo, Wyze), Xiaomi has entered select markets via partner channels. Their differentiator?

Privacy compliance

Compatibility with Amazon Alexa & Google Assistant

Local storage options

Key Takeaways from Xiaomi’s Product Strategy

📌 Localization is Everything

The C300 International Edition is a perfect example — supporting H.265, multiple language UIs, and optimized for unstable networks in rural or emerging markets.

🎯 Focused Differentiation by Region

Baby monitoring models target Western markets

Core sales still depend on value-packed models like the pan-tilt C300

New releases emphasize AI detection and higher resolution (8MP+)

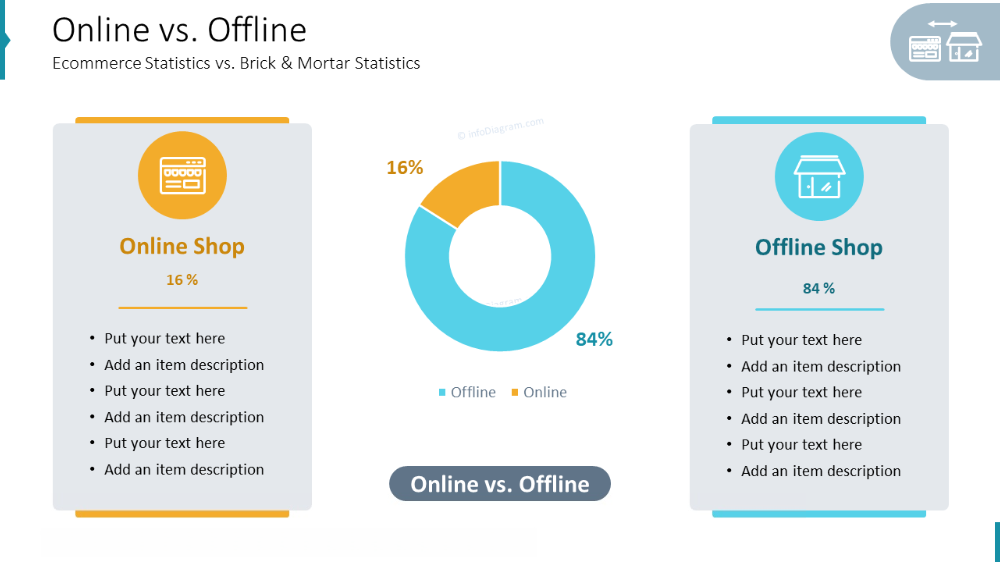

Sales Channels: 70%+ Through Online

Xiaomi’s strength lies in digital channels:

Over 70% of global sales come from online platforms like Amazon, JD, and Lazada

Offline channels are strong in Central Europe but limited elsewhere

Smart home ecosystem integration (e.g., Mi Home App, smart triggers) increases cross-sell value

What This Means for B2B Buyers & Brands (Like You)

If you’re a security brand, importer, or distributor, Xiaomi’s model offers valuable insights:

✅ Online-first strategy: Build digital presence across regional e-commerce platforms

✅ Localized product lines: Offer international versions tailored for bandwidth, storage, compliance

✅ Smart ecosystem value: Integrate with voice assistants, solar, and smart home scenes

👉 Bonus Tip: Consider launching your own C300-style camera with solar panel integration for emerging markets — and promote via regionally targeted Google Ads.

Partner with SNOSECURE for Your Own Smart Camera Line

Looking to launch your ODM or OEM smart camera line for overseas markets?

With 19 years of manufacturing, full customization support, and export experience to 20+ countries — SNOSECURE is your go-to B2B supplier for smart surveillance products.

📩 Contact us now to explore pricing, samples, and partnership.